Personal finance advice: My mom is about to toss thousands of ... - Slate

Pay Dirt is Slate's money advice column. Have a question? Send it to Lillian, Athena, and Elizabeth here. (It's anonymous!)

Dear Pay Dirt,

My mom has been out of work since she married my father. She went from having a good job in her country to being a stay-at-home mom. I am grateful she was there when we were growing up and I think my dad was until he decided to check out of the marriage; they divorced last year. She tried to go back to work multiple times throughout my childhood and adolescence, even when I was an emerging adult. But my dad dissuaded her most of the time or she felt guilty. It doesn't help that she only has outdated qualifications from her home country and no records of her schooling.

This brings me to the problem. My mom has fallen victim to quite a few multi-level marketing/pyramid schemes over the years. She's probably lost some thousands of dollars and has learned there are scams. She's not one to be duped easily, but she would fall for a pitch made by a relative or close friend and invest in the "business" pitched and try to get friends and family to join. She thought of it as finally earning her own income and helping her children/family benefit, too.

She stayed away after one flopped badly, but a close friend has been trying to get her to invest in crypto and some other international investment ventures after my mom experienced financial problems in the divorce. The friend means well, but they have more financial and investment experience on top of their business ventures. If they lose money, they're going to be in a better position to recoup it. My mom will not.

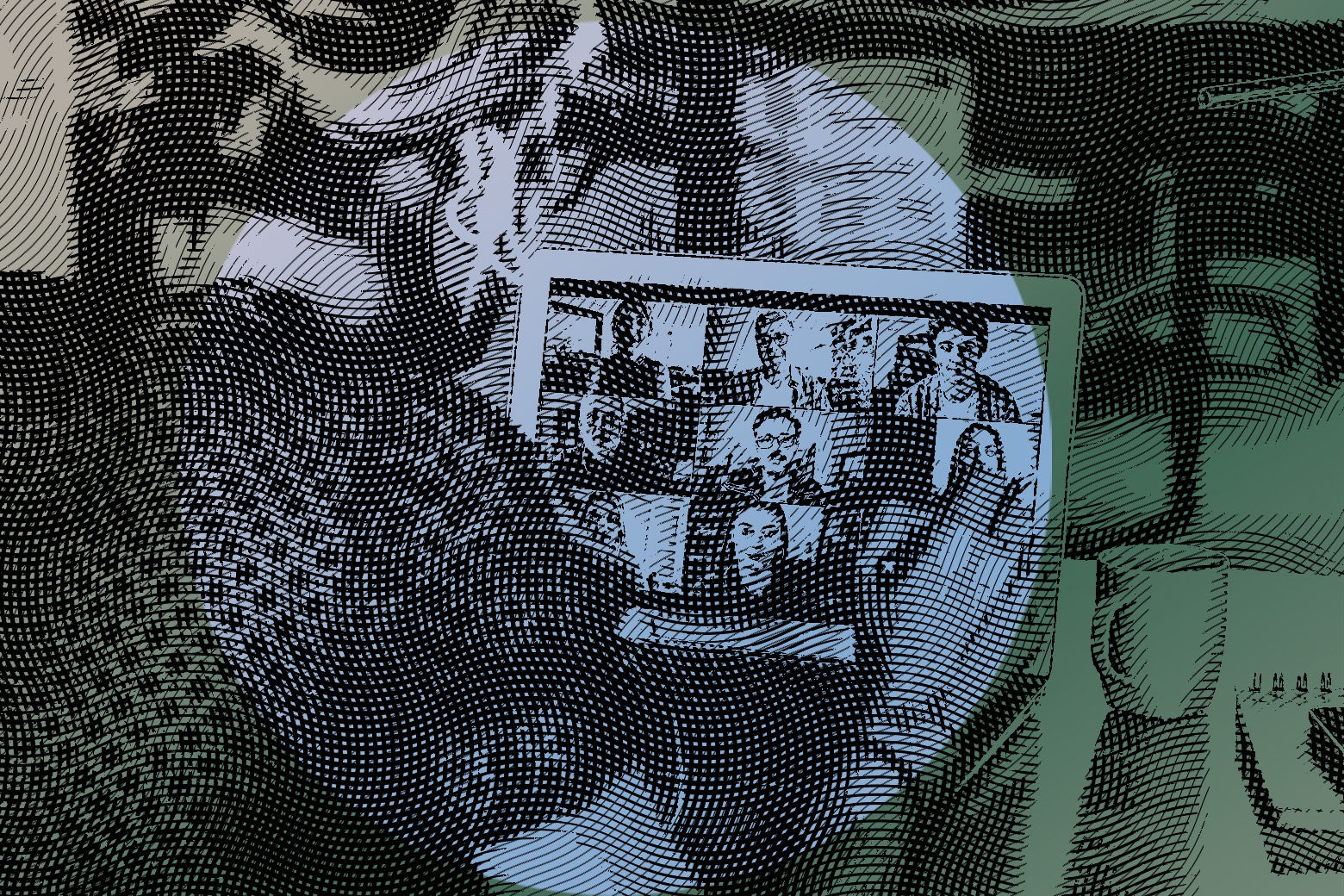

Lately, I've been hearing my mother joining Zooms and listening to videos about "lifestyle" changing technologies opportunities that will allow her to work from home or make passive income. The last one I overheard sounded suspicious. I looked up the company and yep, they're being pegged as a crypto Ponzi scam. How do I explain this to my mother? After the divorce, she has very little money, receives a limited pension (which is another story itself), and has to find a new place to live. The idea that she might invest a few hundred or thousand dollars again is painful for me as her child. What can I do?

—Trying to Avoid Another Pyramid

Dear Avoid Another Pyramid,

I understand your concern for your mother. She's precisely the kind of person that multi-level marketing (MLM) scams target: immigrants, stay-at-home parents, and especially women with lower incomes. MLMs share many of the same psychological practices as cults, making it even harder to talk to people caught in MLM groupthink. Their uplines tell them not to listen to "negative" people, even family members. Even if you're trying to share concerns with a loved one, many don't want to hear that 99 percent of sellers lose money in an MLM venture because they are told not to think negatively. Much of cryptocurrency is having a considerable downturn, and I'd hoped that would scare off less sophisticated investors. Unfortunately, it has caused some crypto-focused pyramid schemes to double down harder on recruitment.

How you approach this with your mother depends on your relationship. If she's generally appreciative of your input, you can express concern over her prospective ventures and ask if you can help her research them to ensure they are safe. Since she'd already sworn off multi-level marketing after a bad experience, you can express wanting to protect her from another blowout. You can even offer to help her look over the numbers—this is an opportunity to conduct some of your own research so you can show that it isn't a good return. Generally, these are good ways to evaluate all business opportunities and investments:

—Do you fully understand this investment and how it works?

—How does this venture make money from you? Is it from dividends on a publicly traded stock, from selling a product, or from recruiting other people?

—Do you have information on this investment from a trusted third-party source, or only from the recruiter and company?

—How is the person who is selling it to you compensated?

—Do you know about the past performance of this investment from your own research?

—Does it promise an unbelievable return?

—Would you invest in this if a friend wasn't selling it to you?

Good starting points for these conversations are the official questions and warning signs from the Federal Trade Commission and Securities and Exchange Commission aimed to help identify an MLM scam. Unfortunately, I've seen first-hand the financial devastation (and resulting divorces) from these crypto pyramid schemes. People could avoid so much economic harm if they just asked this simple: Do I really understand this investment?

If your mom is curious about protecting herself, you can watch some content about the dangers of multi-level marketing and crypto-based assets together (this documentary series, LuLaRich is particularly eye-opening). Best of luck keeping your mother off the bottom of the pyramid.

Want more Pay Dirt every week? Sign up for Slate Plus now.

Dear Pay Dirt,

When is it too late to invest in a Roth account? I am 35, have worked for the federal government for 11 years, and currently have $260,000 in my federal retirement account. I max out contributions and receive the full government match. The government offers a Roth option but I'm not sure if it's too late for me to use it and whether I should just continue to pay into my traditional, but already robust, account to keep that one growing. Is it too late?

—Is the Grass Greener On the Roth Side?

Dear Is the Grass Greener,

It's certainly still possible to contribute to a Roth account at the ripe age of 35. (It used to be that you couldn't contribute to some retirement accounts after age 73, but now that is allowed, in most cases, if you're still working.) The general question about whether or not you should utilize a Roth or a Traditional tax treatment in your retirement account has more to do with your tax situation than your age. If reducing your gross income is helpful for you right now (i.e., you live in a high-tax state for work and have a high income), but you expect your income and marginal tax rate to go down at retirement age, then traditional is a great option.

But Roth has upsides, especially if you expect a cush government pension in addition to your Thrift Savings Plan (TSP). The significant advantage of Roth is that your earnings grow tax-free in the account (and are not taxed on withdrawal as long as it is a qualified withdrawal), and Roth has more flexibility to withdraw without penalties before retirement age. Because some Roth funds can be a valuable tool in retirement planning, consider at least a portion of your funds in a Roth TSP, even if your income is high (especially if you make too much to utilize a Roth IRA).

I often recommend a mix. If you want to stick a foot on both sides of the Roth and traditional fence: You can contribute to both types inside your retirement account as long as your combined contributions fall under the annual limit ($22,500 for a TSP in 2023). Bear in mind any employer contributions from your agency will always go into your traditional TSP balance. But that way you don't have to choose!

Dear Pay Dirt,

Is it ever worth it to be honest with a former co-worker? For context, I used to work with someone who is a know-it-all. Yet they struggled with simple tasks and treated feedback as something that was either not meant for them or grounds for threatening to leave because they couldn't muster basic office courtesy. They were eventually fired and seem to be going on some sort of crusade against the company, acting as if they were massively wronged—but they were actually lucky to have their job as long as they did. They were combative from the start, condescending to co-workers, and constantly made mistakes that they brushed off. They are very intelligent, but I cannot imagine an environment (other than one where they have total control) where they might possibly be happy or not drive everyone around them nuts. As their former manager, who is also no longer at the company, does it make any sense to tell them, "You're the problem, it's you," but nicely?

—Do Not Recommend?

Dear Do Not Recommend,

Don't offer unsolicited feedback to someone you don't even work with anymore. There's nothing to be gained by you from this. This person will either figure out that they are the problem or continue to feel wronged in the world. They already got fired, which is a blow to anyone's self-confidence. If that didn't cause introspection, I doubt your input will. Please save your time and energy; don't seek out opportunities to provide feedback to someone you already know who receives it poorly.

Dear Pay Dirt,

Is there any benefit to paying off a loan with zero percent interest early? I am two and a half years into my car loan, which is zero percent for five years. My monthly payment at purchase was $489, so I set up automatic payments of $500 for the week before the due date and haven't really thought about it since then. I recently earned a large bonus at work around the same time as receiving a small inheritance from my grandmother and have invested most of it but was thinking of paying off the loan with a chunk of it (around $12,000). To me, the peace of mind of not having a loan is very appealing. But is it stupid to use that money to pay off a loan not costing me anything? Should I continue with my payments and just have additional money to invest (or use for some fun)? I am financially healthy otherwise and my emergency fund is already comfortable, so no need for it there.

—No Interest In Keeping No Interest Loan

Dear No Interest,

There are more mathematically efficient ways to use the money than to pay off a zero-percent loan, but if it will provide you peace of mind and won't deplete your emergency reserves, go for it. Just ensure your car note doesn't have any pre-payment penalties on it. Personal finance isn't just about math—it's also about behavior. If it brings you peace of mind to have that car loan gone, I give you permission to write a big check and free yourself of it.

And, you're in luck, because I can also make a mathematical argument for this. While you could invest a $12,000 lump sum into a higher-yield investment, higher returns come with higher risk and a possible long time horizon before you see a return. By paying off the car, you lower your monthly expenses over the next two and a half years, opening up flexibility if you have a loss in income. Instead, you can reallocate the $500 per month you were paying on your car into dollar-cost averaging. This puts that car payment to work investing for you—but provides you with flexibility if your situation changes. So, go ahead, buy the peace of mind by paying off the car, and then direct that $500 per month toward another financial goal.

—Lillian

More Advice From Slate

I have a 4-year-old—let's call her Alice—and an 8-month-old at home right now. I am a firm believer in the principle of "your child isn't giving you a hard time—they are having a hard time." I have always and consistently done the "validate, listen, reflect" process with Alice. But that all went out the window recently.

Comments

Post a Comment