Consumer Spending on Services Keeps up with Raging Inflation in ... - WOLF STREET

Raging inflation is a tough nut to crack for income.

By Wolf Richter for WOLF STREET.

Consumer spending, adjusted for inflation, is now impacted by sharp price drops for fuel and durable goods, and sharp price increases for services. Inflation continues to rage in services, even as goods prices have dropped. I discussed these PCE price indices here a minute ago. So consumers are paying less for many goods than they had to pay a few months ago, but they're paying a lot more for services. About 62% of what consumers spend goes to services.

Spending on services, not adjusted for inflation, jumped 0.5% in December from November, and by 8.7% year-over-year, according to the Personal Consumption Expenditure (PCE) data released today by the Bureau of Economic Analysis.

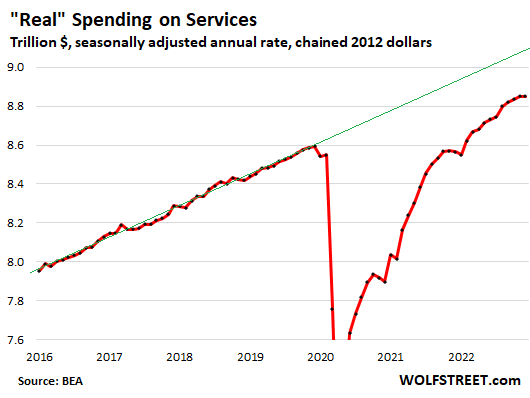

But adjusted for inflation by the PCE price index for services, "real" spending on services remained flat for the month and was up 3.3% from a year ago – 3.3% is decent growth in real spending. Services include housing, utilities, insurance, healthcare, travel bookings, streaming, subscriptions of all kinds, entertainment, repairs, cleaning services, haircuts, etc. On this inflation-adjusted basis, spending on services is still well below pre-pandemic trend:

Goods: prices drop, demand fizzles after pandemic binge.

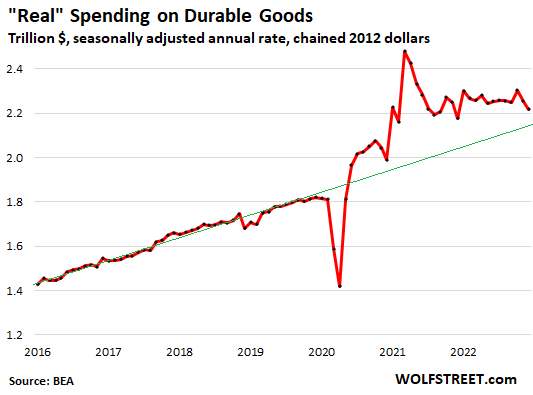

Spending on durable goods, not adjusted for inflation, fell 1.9% in December from November, and was up only 3.2% year-over-year. Durable goods include new and used vehicles of all kinds, appliances, electronics, furniture, etc.

Adjusted for inflation with the PCE price index for durable goods, "real" spending on durable goods fell 1.6% in December from November. Spending fell less than when not-adjusted for inflation because prices have dropped, including prices for used vehicles.

Year-over-year, adjusted for inflation, spending was up only 1.8%, coming off the pandemic binge and is reverting to trend. This was truly a massively overstimulated boom in buying stuff:

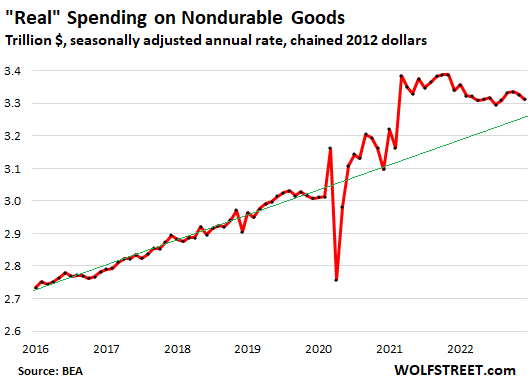

Spending on nondurable goods, not adjusted for inflation, fell 1.4% for the month, on a mix of price drops (gasoline prices plunged, but food prices rose) and dipping demand. Year-over-year, spending was up 5.6%.

Adjusted for inflation, nondurable goods spending fell by 0.4% for the month, and is now negative year-over-year (-0.8%).

Nondurable goods are dominated by food, fuel, and household supplies. Spending, after the pandemic stimulus-fueled binge, is still above pre-pandemic trend, but is reverting to it:

Overall "real" spending growth: slowing.

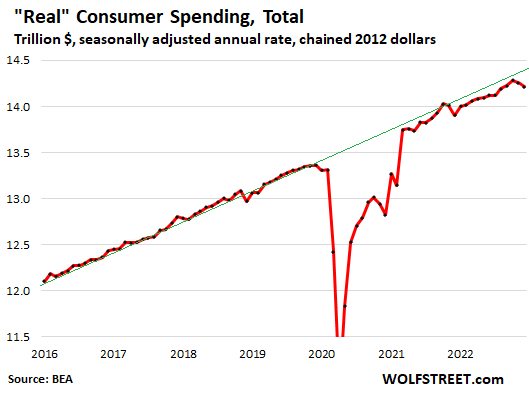

Overall consumer spending on goods and services, not adjusted for inflation, dipped a hair for the second month in a row, but was still up by 7.4% year-over-year.

Adjusted for PCE inflation, total consumer spending on goods and services dipped 0.3%, the second month in a row of declines, and was up 2.2% year-over-year:

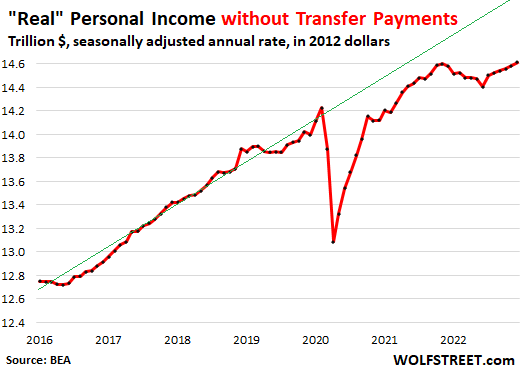

"Real" income without government transfer payments: after inflation-caused cliff-dive, not much recovery.

Adjusted for PCE inflation, income from all sources except government transfer payments (Social Security benefits, unemployment insurance, stimulus payments, welfare, etc.) out-edged PCE inflation for the sixth month in a row, gaining 0.2% for the month.

But this measure of income fell off a cliff in the first half of 2022, when inflation tore into it. Raging inflation is a tough nut to crack for income. You can see the cliff dive here in the first half of 2022, which pushed it far below pre-pandemic trend. Over the past six months, real personal income except transfer payments improved a little, but compared to pre-pandemic trend actually fell further behind. Someone is paying for this inflation, it seems:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Comments

Post a Comment